5 steps to get your clients ready for Payday Super

-4.png)

Things are about to change for all of your payroll clients who pay super.

From 1 July 2026, employers must pay super at the same time as wages under the new Payday Super rules. The goal is to give employees faster access to their super, but for firms and advisors, it means tighter payroll cycles, new cashflow habits, and more pressure to get data right.

The good news is that with the right setup and tools, this transition can be smooth. Early preparation will save hours later, protect client cashflow, and show clients you are ahead of the curve.

Here are five practical steps to help you and your clients get payroll Payday Super ready without adding extra admin.

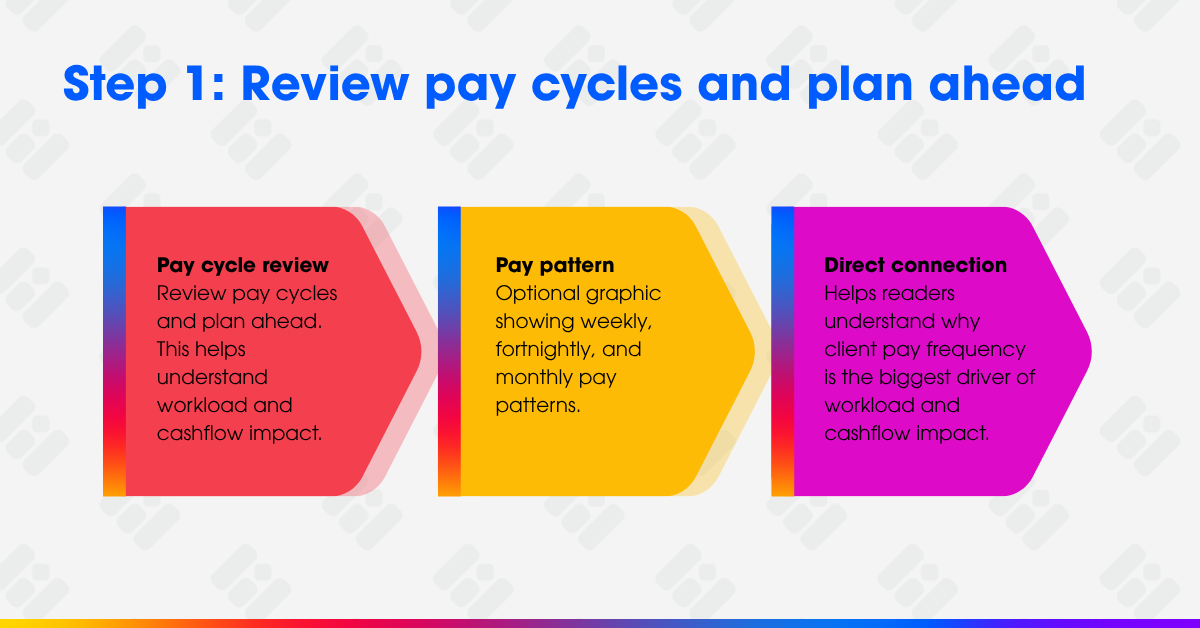

1. Review pay cycles and plan ahead

Under Payday Super, super contributions must be paid with every pay run. Your payroll schedule will determine how often you make those payments.

If you pay fortnightly, plan to send super on the same day you process wages. Your payroll software should handle both payments automatically.

For advisors managing multiple clients, start by mapping out pay frequencies. Clients paying weekly or fortnightly will feel the biggest impact on cashflow, so help them adjust their forecasts and set aside super contributions at the same time as wages.

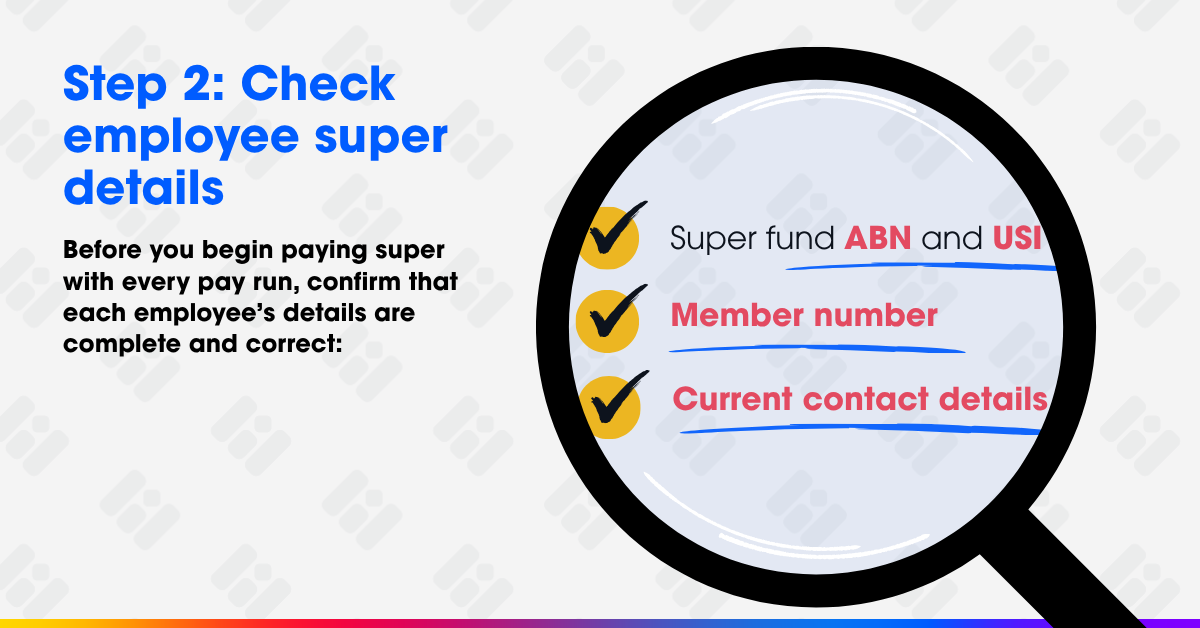

2. Check employee super details

Data accuracy is critical for compliance. From July 2026, the ATO will match STP-reported data with super fund reports, so any mismatch could delay contributions.

Before you begin paying super with every pay run, confirm that each employee’s details are complete and correct:

-

Super fund ABN and USI

-

Member number

-

Current contact details

Even a small error can cause delays or rejections under SuperStream. Reviewing this now helps avoid interruptions when Payday Super begins.

In Easy Business App, you can review and update super details directly from each employee profile before the next pay run, which makes it simple to maintain clean, compliant data across all clients.

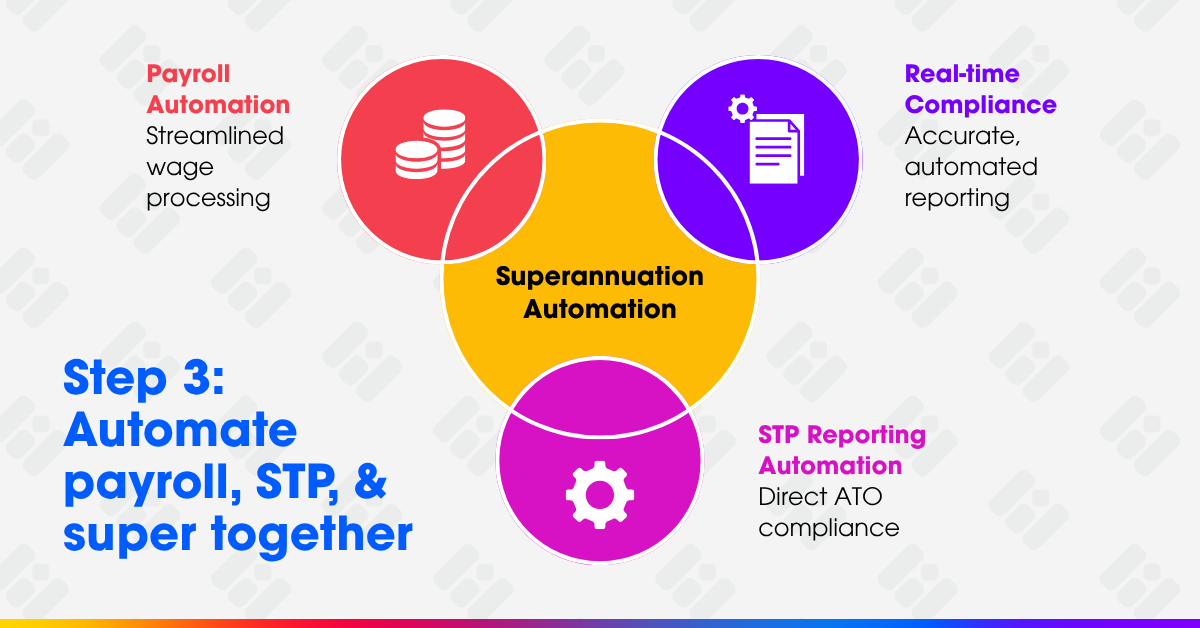

3. Automate payroll, STP, and super together

Manual systems and spreadsheets cannot keep pace with Payday Super. Every pay run will now trigger wage payments, super contributions, and STP reporting to the ATO.

Automation is the easiest way to stay compliant and reduce admin.

With Easy Business App, once a pay run is finalised, super is automatically calculated, paid, and reported through Easy Super, powered by Beam, in the same process.

That means:

- No separate uploads or clearing house payments

- Real-time validation to flag errors instantly

- Payments that clear within two business days

- No extra fees for using Easy Super

Each contribution is SuperStream compliant and reported automatically, which protects both compliance and cashflow.

Remember, late super payments cannot be claimed as tax deductions. Automation helps prevent costly oversights.

4. Test your process before 2026

Running a test pay run early is one of the simplest ways to prepare. Process a pay cycle that includes super payments and confirm that every step from calculation to payment and reporting works smoothly.

For advisors, testing across different client pay frequencies (weekly, fortnightly, monthly) can show how super timing affects cashflow. It can also help identify training needs or workflow gaps before the new rules take effect.

In Easy Business App, advisors can test Payday Super using existing payroll data and see contributions flow automatically through Beam with confirmation messages and error notifications built in.

5. Prepare your team and clients early

Payday Super will change how payroll operates day to day. Everyone involved, from bookkeepers and payroll officers to business owners, will need to understand the new process.

Take the time to explain:

- When the change takes effect (1 July 2026)

- How super will now be paid with each pay run

- How your chosen software manages it automatically

For firms using Easy Business App, the Australian-based support team is ready to help with setup, testing, and staff training via chat, phone, or email. Advisors can also access branded resources and step-by-step guides to share with clients.

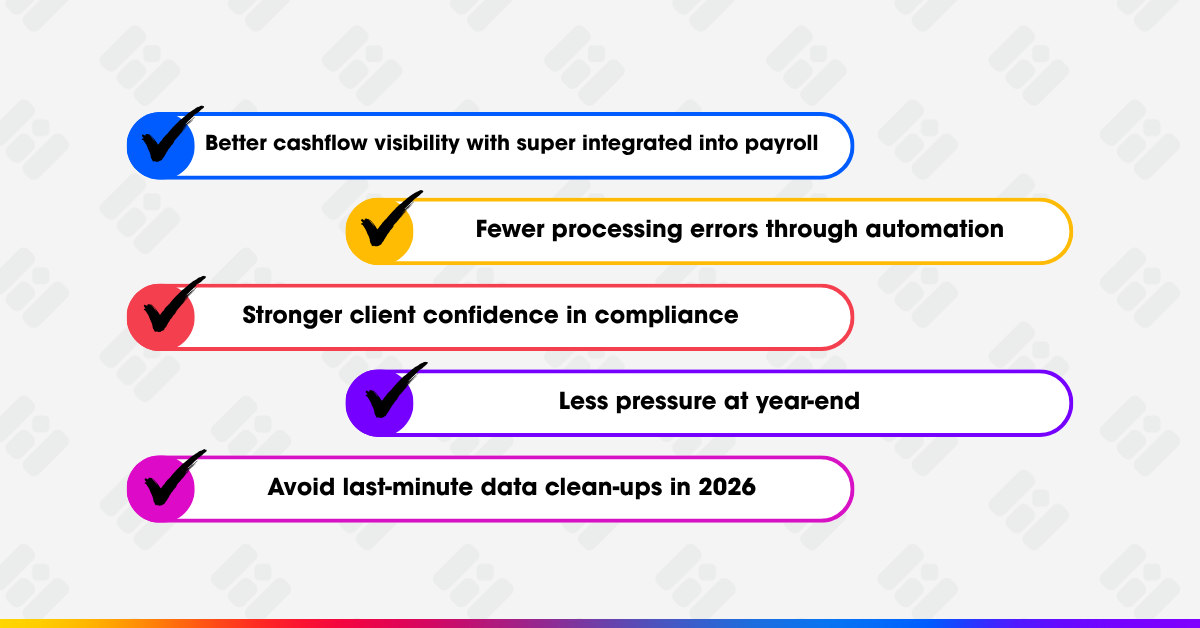

The benefits of preparing early for Payday Super

Preparing early means fewer problems later. The ATO reports that over 20,000 employers were penalised last year for missed or late super payments, and those penalties will increase under the new system.

By starting now, you can:

- Gain better cashflow visibility with super integrated into payroll

- Reduce processing errors through automation

- Give clients confidence that their systems are compliant

- Avoid last-minute data clean-ups in 2026

How Easy Business App simplifies Payday Super compliance

Easy Business App brings payroll, super, and STP together in one platform, built for small businesses and the advisors who support them.

Here’s how it helps you stay ahead:

- One system for payroll, STP, and super

- Automatic super payments and reporting via Beam

- No additional cost for Easy Super

- Real-time validation and two-day clearing

- Works across mobile, tablet, and desktop

- Supported locally in Australia

As Paul Sharpe, CEO of Easy Business App, explains:

“You can start doing Payday Super already. If you want your clients to get used to the cashflow impact, you can start paying super after every pay run today.”

If you already use Easy Business App, activate Easy Super now so your next pay run is Payday Super ready.

Lead your clients through a smooth Payday Super transition

Payday Super is more than a compliance change. It is a shift in how payroll, cashflow, and trust work together.

Advisors who prepare early will save time, reduce risk, and demonstrate proactive support that builds lasting client relationships.

Easy Business App makes that process simple. Payroll, super, and STP all in one place, backed by local support that understands both sides, business owners and the advisors guiding them

👉 Try Easy Business App today and see how payroll and super work together.

👉 Advisors: join our Partner Programme to help your clients get Payday Super ready early

.png?width=812&height=188&name=Easy-Business-app-(colour).png)

.png?width=352&name=Payday%20Super%20Blog%20Tile%20(1).png)