6 Steps to End of Financial Year Success

There are plenty of benefits to having a plan to get organised and on top of things:

Read the latest about payroll, STP, invoicing and small business. Hear from experts, and expand your knowledge with content tailor made for you here at Easy Business App.

There are plenty of benefits to having a plan to get organised and on top of things:

You’re probably already aware that the super guarantee rate is rising from 1 July this year. But you might not understand how that affects you. Don’t...

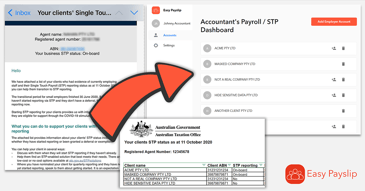

In the last few days the ATO sent Accountants and Tax Agents around Australia a list with all their non STP compliant clients.

Ready to learn more about how to process payroll and STP using Easy Payslip? Our recent webinar covered all this and more:

The ATO’s single touch payroll rule was brought in a year ago, and the ATO has said they will start issuing fines from July for any business that is...

1. Why this is a top priority There is a new sense of urgency this month for small businesses to be STP compliant, now that the one year grace period...

The ATO has legislated all small business to be Single Touch Payroll (STP) compliant. It can be difficult when choosing a payroll solution. As a...

Friday 8 May Update - The government have now announced that you have until 31 May to apply for JobKeeper for the first two fortnights, covering the...

With details recently released confirming that the Government’s JobKeeper payment is linked to Single Touch Payroll reporting, this has created a new...

Are you tired of the stress that comes with payroll? Find it hard to do STP? We understand that you don’t have time to make mistakes when paying...