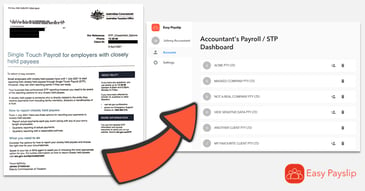

We have rebranded! Still us, but there's more

You may have noticed your screen looks a little bit different, new colours, new logo and a new name. We wanted to communicate this to you so you know...

Read the latest about payroll, STP, invoicing and small business. Hear from experts, and expand your knowledge with content tailor made for you here at Easy Business App.

.png?width=365&name=Untitled%20design%20(10).png)

You may have noticed your screen looks a little bit different, new colours, new logo and a new name. We wanted to communicate this to you so you know...

.png?width=365&name=Blog%20Banners%20(6).png)

To celebrate the launch of our new Easy Business App module, Easy Invoicing, we're committing to planting a tree for every invoice you send this...

-1.png?width=365&name=Blog%20Banners%20(3)-1.png)

You've asked for it, so we made it — Easy Invoicing is now available! Thanks to our incredible team who's been working around the clock, we have...

It would be ideal if paying employees was the same week to week and all you have to do is press send, but life is unpredictable and people may need...

_Originally published: 27/04/2021 | Updated on: 02/09/2021_

_Originally published: 27/04/2021 | Updated on: 02/09/2021_

When Easy Payslip originally launched in 2018, we were the first mobile app that allowed you to process payroll and lodge STP from your phone,...

There are plenty of benefits to having a plan to get organised and on top of things:

You’re probably already aware that the super guarantee rate is rising from 1 July this year. But you might not understand how that affects you. Don’t...

The credit offers up to $200 credit per week for each eligible 16 to 29 year old, and up to $100 credit per week for 30-35 year olds that are new...